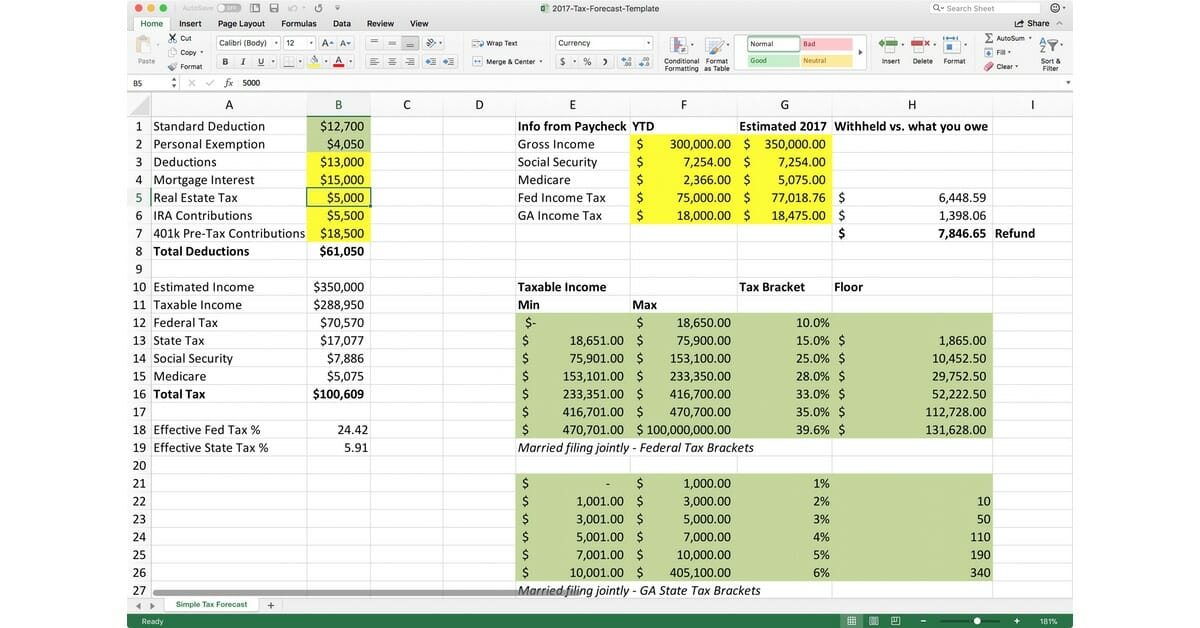

Estimated Tax Payments 2025 Dates Calculator. C corporations that expect to owe more than $500 in taxes for the year must make quarterly estimated tax payments. Learn to calculate and pay federal estimated quarterly taxes with our guide.

Knowing these dates will help ensure that you pay your taxes on time and avoid any potential penalties. In general, quarterly estimated tax payments are due on the following dates in 2025:

Irs Estimated Tax Payments 2025 Calculator Naoma Gwendolin, How to make quarterly estimated tax.

Estimated Tax Payments 2025 Dates Calculator Elsy Karlene, This simple calculator can help you figure out how much you may.

2025 Quarterly Estimated Tax Due Dates Irs Marji Shannah, The due dates for quarterly estimated tax payments in 2025 are.

Estimated Tax Payments 2025 Dates And Forms Barbie Pammie, By providing inputs with respect to income (s) earned and deductions claimed as per the act.

Pa Estimated Tax Payments 2025 Due Dates Tina Adeline, For example, if you worked in california all year, but are in the.

Estimated Taxes 2025 Based On 2025 Tax Return Status Annora Zandra, This helps the calculator figure out which state tax rates it needs to determine your state tax bill.

Estimated Tax Payments 2025 Dates Calculator Joya Rubina, You can estimate taxes by yourself or you can use an estimated tax calculator.

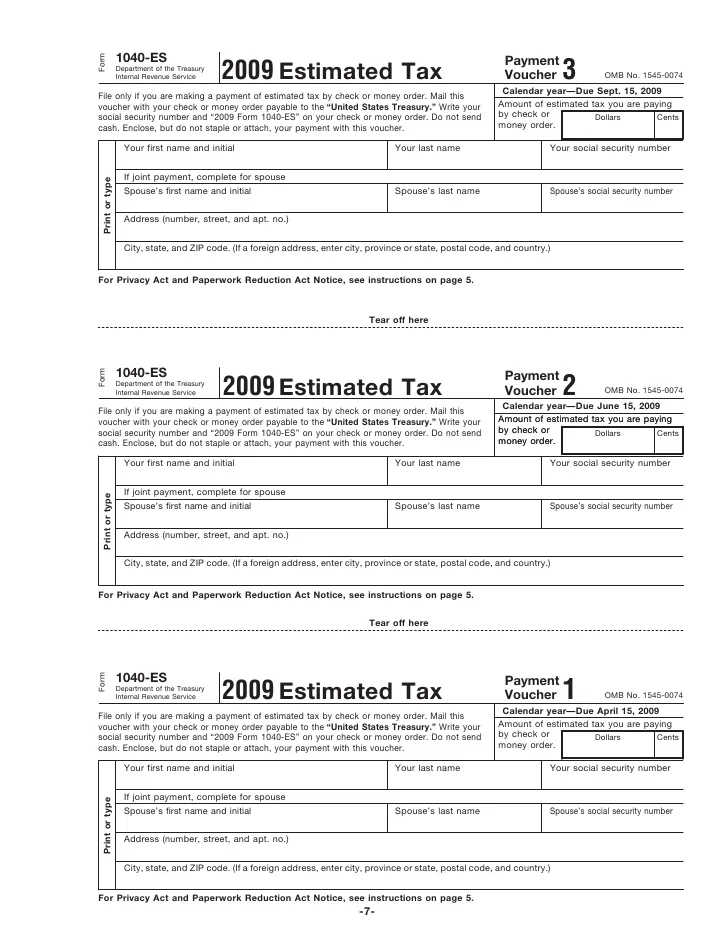

Estimated Tax Due Dates [2025 Tax Year], When a due date falls on a weekend or holiday, your quarterly payment is due the following business day.

Equipment Rental WordPress Theme By WP Elemento